Partnering with small businesses is our sweet spot

More than half a million businesses trust us to manage their payroll services for them — many have as few as one employee. We know each business is unique, which is why we’ve built SME payroll services specifically to help you:

- Focus on your business, not payroll

- Run cloud-based payroll accurately and easily

- Navigate the complexities of compliance

- Generate IR56 tax forms

- Calculate and file MPF and other mandatory contributions on your behalf

- Receive monthly and annual reports

- Access payroll experts when needed

Our small business payroll services enable you to:

ADP – the payroll vendor you can trust

As payroll experts for over 70 years, we understand small businesses and the unique nature of individual payroll runs. We’ve built small business payroll services that take the pressure off business owners like you, so you can get on with what you do best.

Join the more than half a million small businesses who already trust us with managing their payroll. Our SME payroll services are affordable, save you time and help you sleep easier, whether you have one employee or many.

Get a free quote

The benefits of ADP small business payroll solutions

With ADP you only pay for what you need, helping you keep your costs down. Our small business payroll services offer a customisable and scalable pricing model, paid per employee, per pay cycle, which gives you the flexibility to meet your changing needs. We also have a variety of extra administration and service options.

ADP small business payroll solutions adapt to fit your individual needs, whether you want to retain some control over payroll tasks, or hand over complete control of all your payroll processes. We offer flexible and scalable payroll outsourcing services, enabling you to scale up your needs and add on HR capabilities too.

Our small business payroll services don’t just ensure employees are paid accurately and on time, because that’s not all you need from a payroll services provider. You also need protection from liabilities and demonstration that compliance has been followed. The wrong small business payroll services provider could put your company at risk from not following regulatory requirements, which can result in costly fines. ADP helps small businesses navigate today’s complexities including regulatory changes, compliance, audits, employee experience and handling sensitive payroll data.

To keep complexity at bay we make it our job to stay on top of regulations. Did you know that within 30 days the Covid-19 pandemic had driven a fourfold increase in new regulations impacting payroll?1

These include payroll and tax regulations, wage and hour laws, new hire reporting and much more. Our world-class Global Security Organisation helps ensure that your and your employees’ data is safe and secure. ADP is ranked #1 among Business Service Peers by Security Magazine and ISO 9000 and ISO 27001 certified — the gold standards for quality and security process management.

1 ADP Volume of new regulations April 2020 vs April 2019.

How our small business payroll solutions work

You can either choose our payroll managed service or processing service.

Payroll managed service

Our team of ADP experts manage the majority of your small-business payroll processing by reducing the need for your full back-office payroll department. You’ll have dedicated ADP specialists available for you when needed, handling payroll application updates and upgrades along with keeping your payroll system compliant with labour-related legislation. We’ll also control the quality of your payroll and handle mandatory reports.

Payroll processing service

We host the processing platform while you manage data entry and validate the data output. ADP payroll cloud software is agile, flexible and robust. Your payroll automatically calculates employees’ pay and MPF contributions, and issues payslips. You stay compliant with payroll regulations, the GDPR and China PIPL, while receiving monthly and annual reports.

Product recommendations for small businesses

When you partner with us, you can get a custom solution from payroll experts with the knowledge and experience to deliver. Explore some of our solutions.

ADP® OneHR

FOR ORGANISATIONS OF ALL SIZES

Simplify your payroll process with ADP OneHR, a simple, highly secure payroll solution designed to meet the needs of organisations of all sizes and industries. Transform payroll operations and improve employee efficiency with a secure self-service portal for both your employees and your HR team.

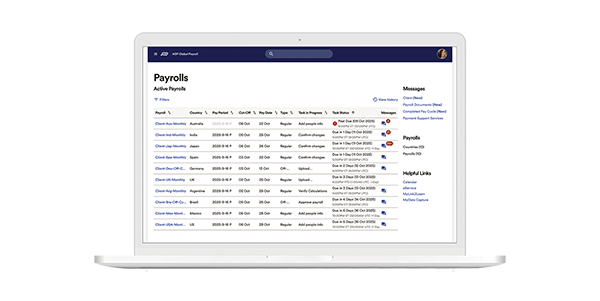

ADP® Global Payroll

MULTI-COUNTRY PAYROLL PLATFORM REGARDLESS OF LOCATION SIZE

- ADP Global Payroll makes it easy for small businesses to manage payroll across several countries with one simple, reliable system.

- It centralizes employee data, streamlines processes, and ensures accuracy and compliance, so you can focus on growing your business.

- With built-in integrations and local expertise, ADP helps you stay compliant and efficient from the very first country you expand into.

Awards & Recognition

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.

FAQs

Your small business questions, answered.

How do small businesses manage payroll?

If you’re a small business, managing payroll is probably one of your least favourite activities. It can be complex, time-consuming, prone to manual errors – not to mention keeping up with compliance regulations. The smart, cost-effective choice is to outsource your payroll to a trusted provider who’ll run your payroll accurately and ensure you meet your compliance obligations. Leaving you time to focus on running your business.

How does payroll work for a small business?

A small business needs flexibility to adapt as it grows. A payroll solution helps your business adapt as you pay per employee, per month. At ADP we offer payroll outsourcing services where you fully outsource your payroll to us. We ensure that your people are paid accurately and on time, while protecting your business from liabilities. Your employees can then view their payslips and manage leave anytime, anywhere via our secure cloud payroll portal software.

How much does it cost for Small and Medium-sized Enterprises (SME) to outsource payroll?

Outsourcing your payroll to a provider like ADP can save your small company valuable time and money – both in short supply when wearing multiple business hats. Gone are the costs of setting up, training, and running an internal payroll department, while contending with admin and compliance regulations. This way, you save time managing your payroll and keeping up with regulation changes.

Why choose ADP for small business payroll?

Over half a million small businesses like yours trust ADP to take care of their payroll services. Perhaps it’s because we have over 70 years of experience in payroll. Or maybe because our small business payroll solutions are affordable, saving you time and complexity, and can be scaled up or down to meet the changing needs of your business.